Oh, 8 have other issues, but I just put the most obvious easy to agree to ones.What was the final tally of the Dubya-Obama wars, 6 trillion, 10?

You are forgetting the Greenspan Put, I know that was a decision of that Judas, but Dubyah could have yeeted the damned twofaced fucker.Maybe his incompetent handling of the economy was also somehow related to the Enron meltdown, too, which just produced a ton of ineffective bullshit regulation written to order for fatcat auditing firms that does not work.

That shit was one of the primary contributors Subprime Mortgage crisis, IMHO.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Business & Finance Economic Fallout: Pandemic, Brandon, Money Printer Go Brr, Ukraine.

- Thread starter Floridaman

- Start date

More options

Who Replied?Agent23

Ни шагу назад!

My biggest beef with the fucker is that he let the Subprime mortgage crisis happen by letting morons print money.Oh, 8 have other issues, but I just put the most obvious easy to agree to ones.

Agent23

Ни шагу назад!

Ok, this is not 100% on topic, but people have mentioned ETFs here and I have raised some concerns about them.

So, here is an interesting video with Mark Green discussing some of the potential issues with the "passive" investing strategy.

Frankly IMHO this will fuck up the next financial crisis will be made worse by the robot.

So, here is an interesting video with Mark Green discussing some of the potential issues with the "passive" investing strategy.

Frankly IMHO this will fuck up the next financial crisis will be made worse by the robot.

Last edited:

LordsFire

Internet Wizard

My biggest beef with the fucker is that he let the Subprime mortgage crisis happen by letting morons print money.

You are again showing your ignorance of what has actually happened.

The Bush Administration repeatedly brought the rising issue of subprime mortgages before congress, saying 'this is a serious problem brewing,' but congressional Democrats (and some Republicans) basically closed their eyes, stuck their fingers in their ears, and said 'nya nya nya can't hear you.'

Then blamed him when everything melted down a couple years later.

Bush has some serious things to answer for. Subprime is not one of them.

posh-goofiness

Well-known member

Good thing I've been stockpiling food for a while now :/

Floridaman

Well-known member

Well, if anyone needed another reason to get their money out of the stockmarket, things like this happening add another reason.

Turns out that a lot of Boomer fools cannot tell real from parody Twitter accounts, and act accordingly.

To be fair parody is now usually just prophecy, see the bablyon bee.

Terthna

Professional Lurker

Well, if anyone needed another reason to get their money out of the stockmarket, things like this happening add another reason.

Turns out that a lot of Boomer fools cannot tell real from parody Twitter accounts, and act accordingly.

There is something seriously wrong with a system when a joke can cause that much damage.

There is something seriously wrong with a system when a joke can cause that much damage.

Were in for another crash this one under bidens watch.

Because the boomers started their mass retirement this year it also meant that the global fincial credit glut started ending this year. That was baked into the system by global demographics and there is no way out of it. The global system america created with breton woods is crashing and burning at the same time.

Essentally american's got tired of going out and protecting every ones shipping for free while others countries essentally treated us like shit for it. That process of disengagement started 30 years ago accelerated under trump, got worse because of covid and Putin put the final nail in the global system.

So just by fundamentals this was going to be a bad year for the global economy no matter what happened. Add in the envitable chinese crash, the effects of the war on europe and other fuckery and of course the economy is going to tank.

And the democrats will own all of it.

2020 is a poisoned chalice and the left has no choice but to drink deeply.

Blasterbot

Well-known member

got me some rabbits, quail, and chickens. also working on a greenhouse to go with the garden. should still probably pick up some emergency food and extra ammo. never can have too much ammo. kinda sad we switched from a wood furnace to propane now. wood took some work but that heating bill is gonna be pricey next year.Good thing I've been stockpiling food for a while now :/

DarthOne

☦️

Washington state gas stations run out of fuel, prep for $10 a gallon

nypost.com

nypost.com

California’s $6 gas prices may spread nationwide, analysts warn

nypost.com

nypost.com

Bad news: America is likely facing a deeper-than-normal recession

nypost.com

nypost.com

rumble.com

rumble.com

WATCH: Bill Gates received $3.5 mill in investor money for his lab-made baby milk startup. Then, the Gates Foundation paid The Guardian $3.5 million. Immediately, The Guardian published a hit piece criticizing breastfeeding as bad for moms' mental health.

Washington state gas stations run out of fuel, prep for $10 a gallon

Gas stations in Washington state are resetting price boards to accommodate double digits in preparation of the price of fuel reaching $10 a gallon.

Gas stations in Washington state are resetting their price boards to accommodate double digits in preparation for fuel prices potentially reaching $10 a gallon, according to a report.

The move comes as several gas stations in the Evergreen State ran out of fuel, the Post Millennial reported.

At the 76 gas station in Auburn, about 30 miles south of Seattle, gas pumps were reprogrammed so the display could indicate a price of at least $10 a gallon.

The displays were limited to single digits as recently as March, but the surging price of gas has led to the change.

A 76 spokesperson told the Post Millennial that the change did not necessarily mean the company was predicting gas prices would reach $10 a gallon.

The station in Auburn also sells race fuel, which is more expensive than the fuel that is used by ordinary citizens.

Race fuel costs more due to the high-octane, premium fuel that is required to enable the engine to have a higher compression ratio, giving it a more energetic explosion and improving the performance of turbocharger and supercharger engines.

Washingtonians are also having to contend with gas stations that are running out of fuel.https://nypost.com/2022/05/18/californias-6-gas-prices-may-spread-nationwide-analysts/

Motorists who drive up to gas pumps in Kennewick, Pasco and West Richland are met with notes indicating that the station does not have any fuel to sell — except diesel.

On Facebook, local residents are reporting more than 10 gas stations that are out of fuel.

The average price of a gallon of gas in Washington state is $5.18 — well above the national average of $4.59 as of Thursday, according to AAA.

The most expensive gas in the nation could be found in California, where motorists in and around San Francisco pay more than $6 a gallon.

Limited supply exacerbated by the Russian invasion of Ukraine, coupled with what is expected to be sky-high demand as Americans take to the roads this summer for travel, will likely push gas prices even higher, analysts warn.

US crude was trading at $112.31 per barrel while Brent crude, the international standard, was trading at $112.89 per barrel, according to the US Energy Information Administration.

The only three states that had been below $4 a gallon as of Monday — Georgia, Kansas and Oklahoma — crossed the threshold on Tuesday, AAA reported.

The oil and gas industry has criticized the Biden administration for its policies that they say have kept supply limited.

Last week, the Biden administration announced that it was canceling three oil and gas lease sales scheduled in the Gulf of Mexico and off the coast of Alaska — removing millions of acres from possible drilling.

The Interior Department announced the decision last Wednesday night, citing a lack of industry interest in drilling off the Alaska coast and “conflicting court rulings” that have complicated drilling efforts in the Gulf of Mexico, where the bulk of US offshore drilling takes place.

The decision likely means the Biden administration will not hold a lease sale for offshore drilling this year and comes as Interior appears set to let a mandatory five-year plan for offshore drilling expire next month.

“Unfortunately, this is becoming a pattern — the administration talks about the need for more supply and acts to restrict it,″ said Frank Macchiarola, senior vice president of the American Petroleum Institute, the top lobbying group for the oil and gas industry.

“As geopolitical volatility and global energy prices continue to rise, we again urge the administration to end the uncertainty and immediately act on a new five-year program for federal offshore leasing,″ he said.

California’s $6 gas prices may spread nationwide, analysts warn

California’s $6 gas prices may spread nationwide, analysts warn

The average price for gasoline could hit $6 nationwide by the end of the summer after it crossed the dreaded the threshold in California, according to analysts at JPMorgan. Limited supply exacerbat…

The average price for gasoline could hit $6 nationwide by the end of the summer after it crossed the dreaded the threshold in California, according to analysts at JPMorgan.

Limited supply exacerbated by the Russian invasion of Ukraine, coupled with what is expected to be sky-high demand as Americans take to the roads this summer for travel, will likely push gas prices even higher.

US crude rose to $114.07 per barrel while Brent crude, the international standard, was trading at $114.86 per barrel as of Tuesday, according to the US Energy Information Administration.

“There is a real risk the price could reach $6+ a gallon by August,” Natasha Kaneva, head of global oil and commodities research at JPMorgan, told CNN on Tuesday.

“With expectations of strong driving demand … US retail price could surge another 37% by August,” JPMorgan analysts wrote in a report.

The average price of a gallon of gas rose nationwide to a record $4.56 on Wednesday, according to AAA.

The only three states who were below $4 a gallon as of Monday — Georgia, Kansas, and Oklahoma — crossed the threshold on Tuesday, AAA reported.

A week ago, the average price of gas per gallon was about 16 cents cheaper. Last month, the average was 48 cents cheaper. A year ago, the average cost of a gallon of gas was $3.04.

California leads the nation in highest average price per gallon, according to AAA. As of Wednesday, a gallon of gas in the Golden State cost $6.05. Motorists in the Bay Area as well as Los Angeles County were feeling the pinch.

Gas in San Francisco cost $6.30 per gallon on average, while in nearby Marin County in went for $6.27. In Los Angeles, motorists were paying $6.09 per gallon.

The state with the cheapest gas as of Wednesday was Kansas, where a gallon sold for $4.03.

The only way that gas doesn’t reach $6 per gallon is if demand drops due to the sky-high prices.

The oil and gas industry has criticized the Biden administration for its policies which they say have kept supply limited.

Last week, the Biden administration announced that it was canceling three oil and gas lease sales scheduled in the Gulf of Mexico and off the coast of Alaska — removing millions of acres from possibly drilling.

The Interior Department announced the decision last Wednesday night, citing a lack of industry interest in drilling off the Alaska coast and “conflicting court rulings” that have complicated drilling efforts in the Gulf of Mexico, where the bulk of US offshore drilling takes place.

The decision likely means the Biden administration will not hold a lease sale for offshore drilling this year and comes as Interior appears set to let a mandatory five-year plan for offshore drilling expire next month.

“Unfortunately, this is becoming a pattern — the administration talks about the need for more supply and acts to restrict it,″ said Frank Macchiarola, senior vice president of the American Petroleum Institute, the top lobbying group for the oil and gas industry.

“As geopolitical volatility and global energy prices continue to rise, we again urge the administration to end the uncertainty and immediately act on a new five-year program for federal offshore leasing,″ he said.

Bad news: America is likely facing a deeper-than-normal recession

Bad news: America is likely facing a deeper-than-normal recession

There’s no doubt America is spiraling into a deep recession with interest rates increasing, inflation skyrocketing and the gross domestic product shrinking. It’s about to get worse.

Formula for disaster: Bill Gates' BIOMILQ pushing formula shortageTolstoy famously wrote that all happy families resemble one another, but each unhappy family is unhappy in its own way. He might have said the same about unhappy economies — and added that there are all too many signs the US recession now in the works will likely be of the particularly unhappy kind.

Among the reasons to fear a deeper-than-normal recession is that monetary-policy tightening is causing the equity and credit market bubbles to burst. Since the start of the year, not only has the Federal Reserve’s abrupt policy shift wiped out almost 20% of the stock market’s value; it has also wiped out nearly 20% in the bond market’s value and close to 50% in the value of exotic markets like bitcoin.

The combined evaporation of some $12 trillion, or 50% of gross domestic product, in household wealth since the start of the year must be expected to cool consumer demand in time. Households will begin to stress about their reduced 401(k)s, which will make them want to rebuild their savings. According to the Federal Reserve, for every sustained $1 loss in household wealth, consumers tend to reduce their spending by 4 cents.

This means that, although consumer spending has held up well to date, because of their financial-market losses, consumers might soon be expected to reduce spending by as much as 2% of GDP. This is the last thing we need when consumers are already cutting back because of soaring gasoline and food prices and because their wages are being eroded by high inflation.

Another cause for concern is that the Fed’s tightening has led to an abrupt jump in the 30-year mortgage rate from around 3% at the year’s start to 5.5% at present. This has reduced the affordability of housing by 25%. That in turn is already leading to a marked cooling in housing demand.

It is also not helping matters that the shift to a very much tighter monetary policy stance is coinciding with the fading of last year’s massive $1.9 trillion American Rescue Plan stimulus. The International Monetary Fund says this will result in an approximate halving in the US government budget deficit from 10% of GDP in 2021 to less than 5% of GDP in 2022. So not only will the economy have to cope with higher interest rates — it will also have to learn to live with very much less government policy support than it had before.

Further clouding the US economic outlook is the much more difficult external environment for US exporters as a result of a surging dollar and a weakening of the rest of the world economy.

The dollar has risen to a 20-year high as foreigners have been attracted by higher US interest rates and the safety of US Treasury bonds at a time of global financial market turbulence. At the same time, the world economy is experiencing a synchronized economic slowdown with the simultaneous weakening in the Chinese, European and emerging-market economies. Unlike in 2008, when strong Chinese economic growth supported the world economy, we can’t count on China to be the main engine of growth because of President Xi Jinping’s economically damaging zero-tolerance COVID policy.

Last year, Fed Chairman Jerome Powell kept assuring us that the rise in inflation was transitory — only to find that inflation surged to a 40-year high. Today, he is assuring us that he can reduce sky-high inflation by engineering a soft economic landing even though all the clues are pointing in the opposite direction. Let us hope that this time Powell is right to be optimistic and we are spared an unusually hard and unhappy economic landing.

Desmond Lachman is a senior fellow at the American Enterprise Institute. He was formerly a deputy director in the International Monetary Fund’s Policy Development and Review Department and the chief emerging market economic strategist at Salomon Smith Barney.

Formula for disaster: Bill Gates' BIOMILQ pushing formula shortage

Please share and subscribe before this video gets censored. Here is a timeline for reference: JUNE 2020 - Bill Gates announced a startup called BIOMILQ. It’s backed by some of the richest investors in

JUNE 2020 - Bill Gates announced a startup called BIOMILQ. It’s backed by some of the richest investors in the world, like Zuckerburg. It raised $3.5 million in Series A funding from Breakthrough Energy Ventures. Breakthrough Energy Ventures is Bill Gates’ investment firm focused on climate change.

SEPTEMBER 2020 - Remember that $3.5 million in BIOMILQ money? Well, according to a receipt from the Gates Foundation, it paid The Guardian $3.5 million in September 2020. This was an initial offering from the Gates Foundation. Of course, right after on September 27, the Guardian published an article entitled “Antibodies in breast milk remain for 10 months after Covid infection – study.”

February 2022 - Customs and Border Patrol officers said that they inspected 17 separate shipments of formulas that came from Europe. Border patrol consulted with the FDA. Of course, the FDA said it had safety concerns about noncompliant baby formula. The same month, the FDA announces it is looking into bacterial contamination at the Abbott formula production plant in Michigan that's supposedly behind the baby formula shortage.

MAY 2022 - The Gates Foundation paid the Guardian again as part of annual funding. The very next day, The Guardian wasted no time and published a hit-piece on breastfeeding. It’s called “Turns out breastfeeding really does hurt - why does no one tell you?”

GATES FOUNDATION: Guardian News & Media Ltd

FDA PRESS RELEASES ON FORMULA PRODUCTION: Press Announcements

WATCH: Bill Gates received $3.5 mill in investor money for his lab-made baby milk startup. Then, the Gates Foundation paid The Guardian $3.5 million. Immediately, The Guardian published a hit piece criticizing breastfeeding as bad for moms' mental health.

DarthOne

☦️

White House dismisses 1,160-point stock plunge as 'not something that we keep an eye on every day'

www.americanthinker.com

www.americanthinker.com

White House dismisses 1,160-point stock plunge as 'not something that we keep an eye on every day'

The monster 1,160 point stock drop on the Dow Jones Industrial Average Wednesday, the highest drop since the advent of the pandemic in 2020 was kind of a ... nothingburger for the Biden White House. According to the Washington Examiner:...

May 19, 2022

White House dismisses 1,160-point stock plunge as 'not something that we keep an eye on every day'

By Monica Showalter

The monster 1,160 point stock drop on the Dow Jones Industrial Average Wednesday, the highest drop since the advent of the pandemic in 2020 was kind of a ... nothingburger for the Biden White House.

According to the Washington Examiner:

The White House downplayed Wednesday’s drop in the stock market and defended the Federal Reserve’s independence after interest rate hikes to curb high inflation.The Dow Jones Industrial Average fell 1,160 points in the worst day of trading since June 2020 as investors expect further rate increases despite assurances from Federal Reserve Chairman Jerome Powell. Many economists think the Fed has been too slow to act to control the price spikes.Seems the Sleepy Joe White House is doing its sleeping. And why wouldn't they? The private sector is full of price gougers, tax cheats, hoarders, wreckers, and other bogeymen of the left. It's not about people's 401(K)s, which is how normal Americans see it. Of course they don't watch stocks, unless perhaps they are in Congress and there's some inside trading to be had. Joe, of course, watches money matters intensely too no matter what he claims as a matter of feathering his nest. The abandoned Hunter Biden laptop emails reveal that well enough.“Nothing has changed in how we see the stock market,” White House press secretary Karine Jean-Pierre told reporters at Wednesday’s briefing. “That’s not something that we keep an eye on every day.”

Besides that, Biden has this pattern as the defining feature of his presidency -- ignoring events, dismissing anyone warning about them as a conspiracy theorist or callin the problem non-existent or all in our heads -- until it gets too big to ignore. We've seen this in Biden's organization of the Afghanistan pullout, in his COVID response, in his pathetic reaction to the rise in oil prices, in his handing of inflation -- transitory, rich man's problem, price gouging, Putin-did-it -- and in his current response to baby formula supply-chain and federal shutdown shortages. He's always reacting, always denying, and then always getting caught flat-footed.

Which is bad stuff, since stock prices are a hell of a lot more than presumed private sector badness for the White House to ignore. Yes, prices go up, and prices go down, and in recent years, there have been big swings.

But stocks also are anticipatory signals, forecasting what the market is expecting on the horizon -- in this case, recession, inflation, stagflation, supply chain issues, and an economy grinding to a halt.

Biden makes a big deal about reading all his fancy intelligence reports. But when news is right there in front of his face, well, Sleepy Joe goes back to sleep. Perhaps he'll get around to reading about it in a few days.

It's like golf. The lower the better.Trying to get that approval rating to 20 percent.

😒

Batrix2070

RON/PLC was a wonderful country.

Okay I'm going to use one simple thing here.WATCH: Bill Gates received $3.5 mill in investor money for his lab-made baby milk startup. Then, the Gates Foundation paid The Guardian $3.5 million. Immediately, The Guardian published a hit piece criticizing breastfeeding as bad for moms' mental health.

Are they seriously that stupid? Fucking hell, Columbus 2.0 found because they discovered America, yes it fucking hurts to breastfeed, no it's not a problem you just have to get used to it unfortunately and if you don't believe ask your mothers if it hurt when they breastfed you.

Agent23

Ни шагу назад!

This was inevitable, and it is just the start, the US stock market has been massively overvalued since before the temporary correction when COVID started.White House dismisses 1,160-point stock plunge as 'not something that we keep an eye on every day'

White House dismisses 1,160-point stock plunge as 'not something that we keep an eye on every day'

The monster 1,160 point stock drop on the Dow Jones Industrial Average Wednesday, the highest drop since the advent of the pandemic in 2020 was kind of a ... nothingburger for the Biden White House. According to the Washington Examiner:...www.americanthinker.com

The Everything bubble will inevitably burst and the longer the Fed fucks around by not hiking the interest rates and not doing QT the bigger the crash will be.

They should have stopped last year, and they should have kept stimulus lower, and crap like Build Back Better and all of the other Biden spending idiocies shouldn't have been a thing, period.

Not that there was any doubt the miserable fuckwit would get reappointed, but still.The Senate reapproved the head of the Fed, Jerome Powell, 80-19

Probably as big of a retard as whoever led the same abominable institution in the 70s and between the 00s and until Obama's second term.

Now, that I think about it, has the creature from Jekyll island ever had a handler pulling its leash besies Volker that had any idea of what they were actually supposed to be doing?

DarthOne

☦️

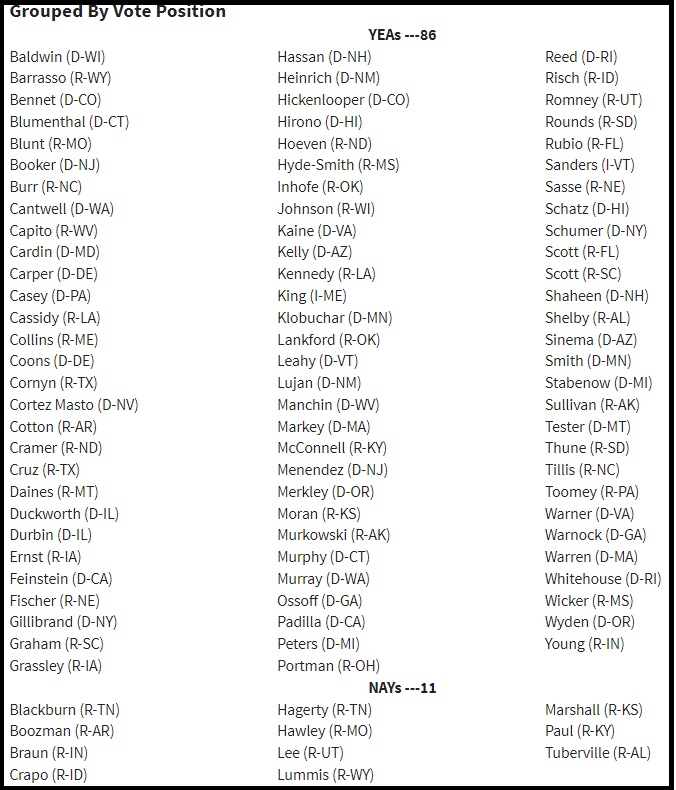

Senate Passes $40 Billion Ukraine Aid Package Expected to Last Five Months, Vote 86-11

Note their names and vote OUT anyone who decided to help Ukraine over the American people.

Exclusive — Sen. Rand Paul: Congress Has to Borrow from China to Send $40 Billion in Aid to Ukraine

www.breitbart.com

www.breitbart.com

Oh as if this couldn't get any better...

The $40 billion UniParty aid package for Ukraine pass the senate this afternoon in a vote of 86-11 (vote tally below).

The Biden administration had originally requested $33 billion, but congress did not feel he was spending enough. The House added an additional $7 billion and passed the $40 billion legislation last week. Today the Senate voted 86-11 to approve the package which is targeted to last 5 months and includes U.S. taxpayers funding the salaries and pension benefits for officials in the Ukraine government.

11 republican senators voted against the massive money laundering operation. They were Senators Blackburn (R-TN), Boozman (R-AR), Braun (R-IN), Crapo (R-ID), Hagerty (R-TN), Hawley (R-MO), Lee (R-UT), Lummis (R-WY), Marshall (R-KS), Paul (R-KY), Tuberville (R-AL).

Note their names and vote OUT anyone who decided to help Ukraine over the American people.

Exclusive — Sen. Rand Paul: Congress Has to Borrow from China to Send $40 Billion in Aid to Ukraine

Paul: Congress Has to Borrow from China to Send $40 Billion to Ukraine

Sen. Rand Paul (R-KY) told Breitbart News Daily that America has to borrow the money to send $40 billion in aid to Ukraine.

Sen. Rand Paul (R-KY) told Breitbart News Daily that America has to borrow the money to send $40 billion in aid to Ukraine.

Breitbart News Daily host Alex Marlow spoke with Paul as the Senate remains poised to pass legislation that would send $40 billion in military and economic aid to Ukraine while Americans grapple with inflation and food shortages. Paul has “single handedly” worked to hold up the Ukraine package, contending that the package needs an inspector general to ensure that the billions of dollars are spent wisely.

Paul said that America would have to continue borrowing from China to appropriate the proposed Ukraine aid package.

“I think it’s important to know that we don’t have any money to send, we have to borrow money from China to send it to Ukraine. And I think most people kind of get that, and many Republicans will say that when it’s a new social program, but if it’s military aid to a country, they’re like we can borrow that, that’s a justified borrowing,” Paul explained to Marlow.

Paul served as one of the 11 Senate Republicans to vote against advancing the Ukraine aid package, which included Sens. Hawley, Mike Crapo (R-ID), Bill Hagerty (R-TN), Mike Braun (R-IN), Marsha Blackburn (R-TN), John Boozman (R-AR), Roger Marshall (R-KS), Cynthia Lummis (R-WY), and Tommy Tuberville (R-AL).

The Ukraine aid procedural vote strikes a contrast between establishment Republican views on foreign policy, which favor more activist intervention abroad, and populist senators such as Paul, who believe that America should not engage in endless wars and conflict abroad.

Paul said that Republicans’ contribution to America’s deficit undermines their argument that President Joe Biden is solely responsible for the rampant inflation under his administration.

The Kentucky senator said, “The problem is that it all leads to inflation, so it kind of hurts the Republican argument that Biden’s spending and Biden’s debt leads to inflation, except for when it’s bipartisan spending and that doesn’t really count.”

Republicans added over $100 billion in new debt with Democrats in providing direct subsidies to semiconductor companies and also by increasing the National Science Foundation, one of the most wasteful organizations in Washington.

Paul lamented in his interview with Breitbart News Daily that many Republicans are now lining up to grant $48 billion in coronavirus relief to restaurants, even though most coronavirus lockdowns have been over for at least a year.

The Kentucky senator noted that many Republicans and Democrats liked the idea of having an inspector general have oversight on the tens of billions of Ukraine aid; however, Senate Majority Leader Chuck Schumer (D-NY) pushed senators away from Paul’s proposal because the inspector general would be “ruthless” with the spending.

Paul said that it is a good idea to have a “zealous guardian” of the taxpayers’ money.

Marlow asked why so many Republicans, even though they sound like Paul in terms of rhetoric, often vote to borrow from China to send money to Ukraine.

Paul said the “bipartisan consensus” is to have Republicans vote for increased military spending, and Democrats boost social welfare spending.

“This is the bipartisan consensus right now on Ukraine. Republican and Democrat leadership are exactly the same. So they get together. But in order to get together to get this, it’s guns and butter, you look at the $40 billion, it’s a lot of guns, but in order to get the gun they had to give out a lot of butter and so there’s a lot of spending going to European countries for food throughout the world,” Paul said.

He added, “What we’ve done is given away the farm to make us weaker.”

Breitbart News Daily airs Monday through Friday from 6:00 A.M. to 9:00 A.M. on Sirius XM Patriot 125.

Sean Moran is a congressional reporter for Breitbart News. Follow him on Twitter @SeanMoran3.

Oh as if this couldn't get any better...

Users who are viewing this thread

Total: 4 (members: 0, guests: 4)