Well you can't deny they fit the club, and for all practical purposes were its buddies already.

Two New Countries Apply To Join BRICS. Details Here

Iran has submitted an application to become a member in the group of emerging economies known as the BRICS, an Iranian official said on Monday.www.ndtv.com

The new club ladies and gentleman.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Business & Finance Economic Fallout: Pandemic, Brandon, Money Printer Go Brr, Ukraine.

- Thread starter Floridaman

- Start date

More options

Who Replied?Arch Dornan

Oh, lovely. They've sent me a mo-ron.

And I shall witness their business partnership to be tested when the sanctions keep getting higher.Well you can't deny they fit the club, and for all practical purposes were its buddies already.

Iran is who Russia has taken the title of the most sanctioned country in the world from.And I shall witness their business partnership to be tested when the sanctions keep getting higher.

And Argentina, well, it's not like they are famous for their great economy and relations with the west.

Arch Dornan

Oh, lovely. They've sent me a mo-ron.

Iran's going to try and bypass that with some new trade corridor. If Russia doesn't get buck broken they might get it working.Iran is who Russia has taken the title of the most sanctioned country in the world from.

And Argentina, well, it's not like they are famous for their great economy and relations with the west.

Argentina meanwhile like the rest of South America's trying to find that opportunity to find a way to get things better for themselves.

History Learner

Well-known member

Things are getting bad out there, everyone. Everyone from basic retail to tech to banking/stocks have either started layoffs or instituting hiring freezes; Wal-Mart in April was literally saying it wanted to hire 50,000 new workers and then by Mid-May had suddenly switched to a hiring freeze. All signs point to a serious recession soon.

Agent23

Ни шагу назад!

Things are getting bad out there, everyone. Everyone from basic retail to tech to banking/stocks have either started layoffs or instituting hiring freezes; Wal-Mart in April was literally saying it wanted to hire 50,000 new workers and then by Mid-May had suddenly switched to a hiring freeze. All signs point to a serious recession soon.

I just love how NETFLIX, Reverend Elon's car company and some randos I have never heard about are at the top of the list.

This is normal and necessary, this is the down part of the cycle, and as such lots of misallocations is being cleaned out of the system.

The up portion of the cycle was basically boosted by all of the Fed's cocaine, er, money printing, as well as the fact that people had to stay indoors and consume more tech services and buy more stuff from WalMart.

Well, as the OG said, "Inflation is like drinking, the good effects are immediate, and the bad ones come later"

A lot of companies thought that the one or two time boost to earnings will continue, so they hired a lot more people.This caused even more wage inflation.

And don't get me started on tech.

There have been years and years, even decades, of misallocation of money where tech companies, particularly profitless projects that make no money for over 10 years, are concerned!

Even big, established companies have silly moonshot projects that are going nowhere fast.

This thing is gonna crash.

Arch Dornan

Oh, lovely. They've sent me a mo-ron.

Agent23

Ни шагу назад!

And outsourcing to places with lower taxes and lower rates and more use of overseas contractors.

So maybe more money for me, despite the crash.

DarthOne

☦️

White House Is Quietly Modeling For $200 Oil "Shock"

www.zerohedge.com

www.zerohedge.com

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

BY TYLER DURDEN

THURSDAY, JUN 30, 2022 - 05:44 AM

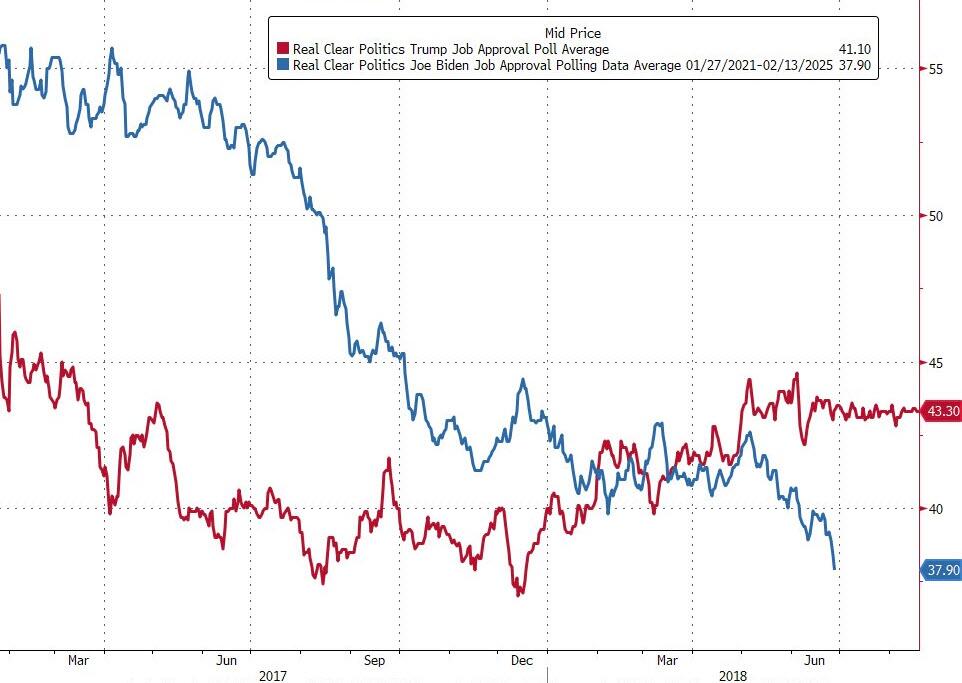

While the Biden administration is hoping and praying that someone - anyone - will watch the comical "Jan 6" kangaroo hearsay court taking place in Congress and meant to somehow block Trump from running for president in 2024 while also making hundreds of millions of Americans forget that the current administration could very well be the worst in US history, it is quietly preparing for the worst.

As none other than pro-Biden propaganda spinmaster CNN reports, when it comes to what really matters (at least according to Gallup), namely the economy, and specifically galloping gasoline prices, the White House is in a historic shambles.

The suspects behind the historic implosion are well known: "soaring prices, teetering poll numbers and congressional majorities that appear to be on the brink have created no shortage of reasons for unease. Gas prices are hovering at or around $5 per gallon, plastered on signs and billboards across the country as a symbolic daily reminder of the reality -- one in which White House officials are extremely aware -- that the country's view of the economy is growing darker and taking Biden's political future with it."For an administration that ended last year forecasting a leveling off of 40-year high inflation and eager to tout a historically rapid recovery from the pandemic-driven economic crisis, there is a level of frustration that comes with an acutely perilous moment. Asked by CNN about progress on a seemingly intractable challenge, another senior White House official responded flatly: "Which one?"

"You don't have to be a very sophisticated person to know how lines of presidential approval and gas prices go historically in the United States," a senior White House official told CNN.

A CNN Poll of Polls average of ratings for Biden's handling of the presidency finds that 39% of Americans approve of the job he's doing. His numbers on the economy, gas prices and inflation specifically are even worse in recent polls. What CNN won't tell you is that Biden is now polling well below Trump at this time in his tenure.

The CNN article then goes into a lengthy analysis of what is behind the current gasoline crisis (those with lots of time to kill can read it here) and also tries to explains, without actually saying it, that the only thing that can fix the problem is more supply, but - as we first explained - this can't and won't happen because green fanatics and socialist environmentalists will never agree to boosting output.

Which brings us to the punchline: as CNN's Phil Mattingly writes, "instead of managing an economy in the midst of a natural rotation away from recovery and into a stable period of growth, economic officials are analyzing and modeling worst-case scenarios like what the shock of gas prices hitting $200 per barrel may mean for the economy."

Well, in an article titled "Give us a plan or give us someone to blame", this seems like both a plan, and someone to blame.

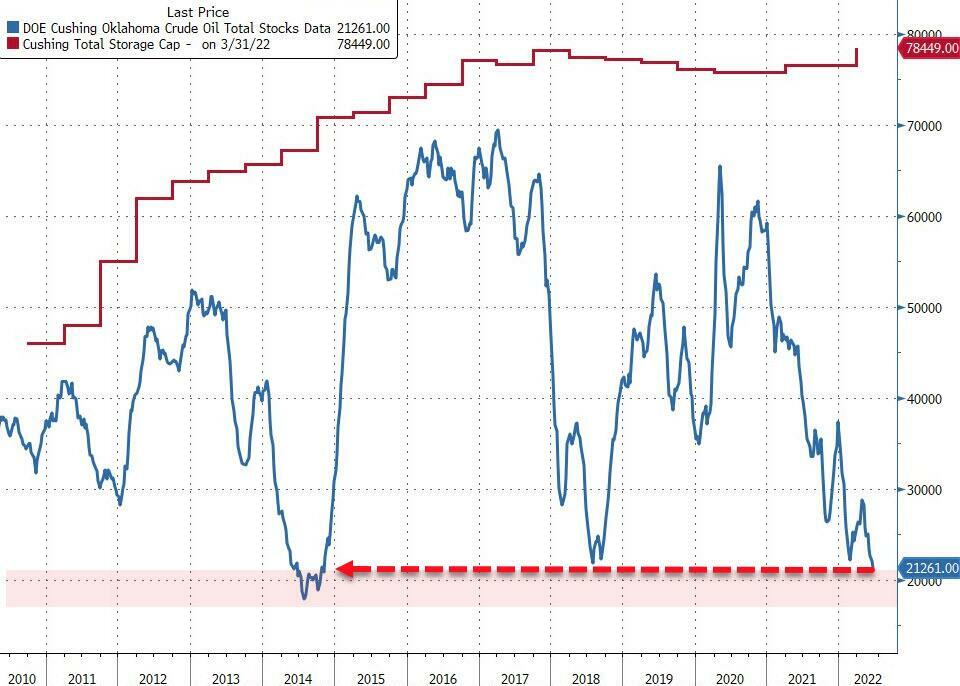

But unfortunately for Biden - and CNN which is hoping to reset expectations - it's only going to get worse, because as we noted moments ago, while nobody was paying attention, Cushing inventories dropped to just 1 million away from operational bottoms at roughly 20MM barrels. This means that the US is officially looking at tank bottoms.

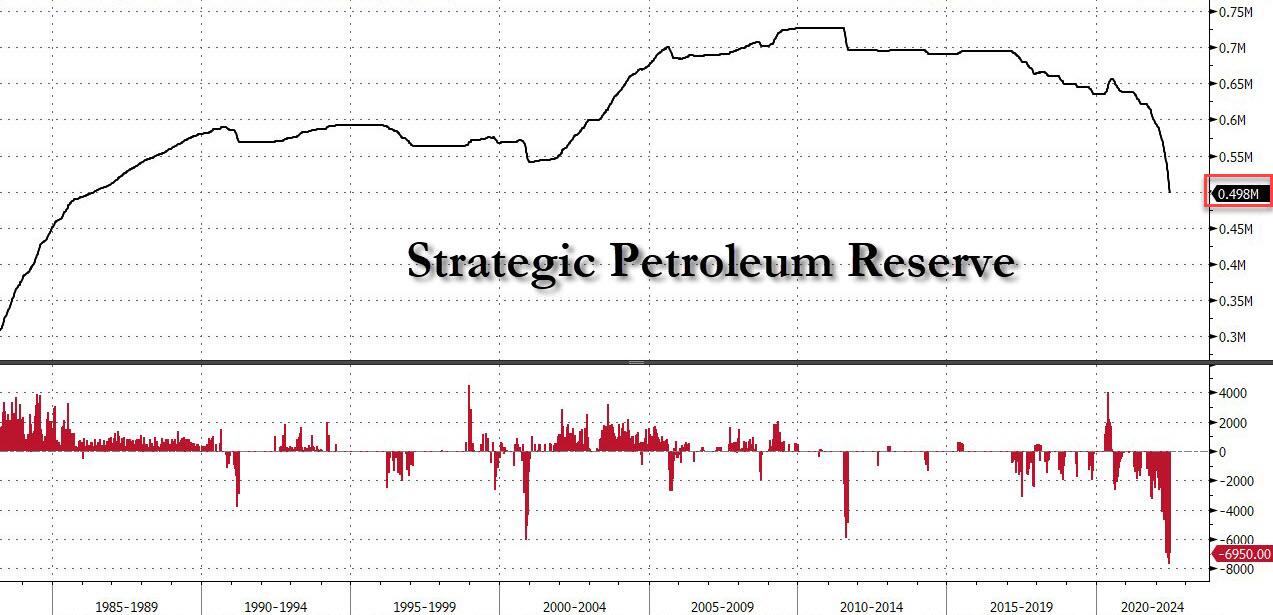

But wait, there's more... or rather, it's even worse, because as even Bloomberg's chief energy guru Javier Blas notes, over the last 2 weeks, the US gov has drained 13.7 million barrels from the SPR, "and yet, commercial oil stockpiles still fell 3 million barrels over the period."

Just imagine, Blas asks rhetorically, "if the SPR wasn't there. Or what would happen post-Oct when sales end."

Javier Blas

@JavierBlas

OIL MARKET: Over the last 2 weeks, the US gov has injected 13.7 million barrels from the SPR into the market. And yet, commercial oil stockpiles still fell 3 million barrels over the period. Just imagine if the SPR wasn't there. Or what would happen post-Oct when sales end #OOTT

10:52 AM · Jun 29, 2022·Twitter Web App

And here is the punchline: at the current record pace of SPR drainage, one way or another the Biden admin will have to end its artificial attempts to keep the price of oil lower some time in October (or risk entering a war with China over Taiwan with virtually no oil reserve). This means that unless Putin ends his war some time in the next 5 months, there is a non-trivial chance that oil will hit a record price around $200 - precisely the price the White House is bracing for - a few days before the midterms. While translates into $10+ gasoline.

And while one can speculate how much longer Democrats can continue the "Jan 6" dog and pony show as the entire economy implodes around them, how America will vote in November when gas is double digits should not be a mystery to anyone.

Carrot of Truth

War is Peace

White House Is Quietly Modeling For $200 Oil "Shock"

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

You can't make people forget about something they get reminded of every time they go to the pump or the grocery store.

DarthOne

☦️

You can't make people forget about something they get reminded of every time they go to the pump or the grocery store.

“You can fool all the people some of the time and some of the people all the time, but you cannot fool all the people all the time.”- Abraham Lincoln

Carrot of Truth

War is Peace

Starting to seem like Fallout was prophetic.

DarthOne

☦️

EXCLUSIVE India's top cement maker paying for Russian coal in Chinese yuan

/cloudfront-us-east-2.images.arcpublishing.com/reuters/PCZ5ORBUANLDFCUJXOXHX6FIUY.jpg)

www.reuters.com

www.reuters.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/PCZ5ORBUANLDFCUJXOXHX6FIUY.jpg)

EXCLUSIVE India's top cement maker paying for Russian coal in Chinese yuan

India's biggest cement producer, UltraTech Cement , is importing a cargo of Russian coal and paying using Chinese yuan, according to an Indian customs document reviewed by Reuters, a rare payment method that traders say could become more common.

NEW DELHI, June 29 (Reuters) - India's biggest cement producer, UltraTech Cement (ULTC.NS), is importing a cargo of Russian coal and paying using Chinese yuan, according to an Indian customs document reviewed by Reuters, a rare payment method that traders say could become more common.

- UltraTech importing from SUEK, valued at 172.7 mln yuan

- SUEK's Dubai unit facilitated trade from Russia's Vanino port

- Traders say other companies set to pay in yuan for Russian coal

UltraTech is bringing in 157,000 tonnes of coal from Russian producer SUEK that loaded on the bulk carrier MV Mangas from the Russian Far East port of Vanino, the document showed. It cites an invoice dated June 5 that values the cargo at 172,652,900 yuan ($25.81 million).

Two trade sources familiar with the matter said the cargo's sale was arranged by SUEK's Dubai-based unit, adding that other companies have also placed orders for Russian coal using yuan payments.

The increasing use of the yuan to settle payments could help insulate Moscow from the effects of western sanctions imposed on Russia over its invasion of Ukraine and bolster Beijing's push to further internationalise the currency and chip away at the dominance of the U.S. dollar in global trade.

The sources declined to be identified as they are not authorized to speak to the media. UltraTech and SUEK did not respond to a request seeking comment.

"This move is significant. I have never heard any Indian entity paying in yuan for international trade in the last 25 years of my career. This is basically circumventing the USD (U.S. dollar)," a Singapore-based currency trader said.

The sale highlights how India has maintained trade ties with Russia for commodities such as oil and coal despite the western sanctions. India has longstanding political and security ties with Russia and has refrained from condemning the attack in Ukraine, which Russia says is a "special military operation".

It was not immediately clear which bank opened a letter of credit for UltraTech and how the transaction with SUEK was executed. SUEK did not respond to a request seeking comment.

The Mangas is currently at anchor near the Indian port of Kandla, according to ship-tracking data on Refinitiv Eikon.

INDIA-CHINA-RUSSIA TRADE

India has explored setting up a rupee payment mechanism for trade with Russia, but that has not materialized. Chinese businesses have used the yuan in trade settlements with Russia for years.

For Indian trade settlements using the yuan, lenders would potentially have to send dollars to branches in China or Hong Kong, or Chinese banks they have tie-ups with, in exchange for yuan to settle the trade, two senior Indian bankers said.

"If the rupee-yuan-rouble route turns out to be favourable, the businesses have every reason and incentive to switch over. This is likely to happen more," said Subash Chandra Garg, a former economic affairs secretary at India's finance ministry.

India's bilateral trade with China, for which companies largely pay in dollars, has flourished even after a deadly military clash between the two in 2020, though New Delhi has increased scrutiny on Chinese investments and imports, and banned some mobile apps over security concerns.

An Indian government official familiar with the matter said the government was aware of payments in yuan.

"The use of the yuan to settle payments for imports from countries other than China was rare until now, and could increase due to sanctions on Russia," the official said.

India's energy imports from Russia have spiked in the recent weeks as traders have offered steep discounts, Reuters reported this month. New Delhi defends its purchases of Russian goods saying a sudden halt would inflate prices and hurt consumers.

Business units of Russian coal traders in Dubai have become active hubs for facilitating deals with India in the recent weeks, as Singapore has grown wary of provoking western nations that invoked sanctions against Russia, said multiple coal traders based in Russia, Singapore, India and Dubai.

A Russian coal trader based in Dubai said the biggest challenge was sending roubles to Russia.

"You can either take payments in yuan in Dubai, or receive it in dollars or (Arab Emirates) dhiram and convert it to rouble" he said, adding it was easier to convert the yuan to rouble and was preferred over other currencies.

($1 = 6.6899 yuan)

Agent23

Ни шагу назад!

Starting to seem like Fallout was prophetic.

Except that we don't have any of the cool tech!!!

Sobek

Disgusting Scalie

Some economic news that might foreshadow a massive change... I have heard that many countries are refusing to take part on the ban, but I cannot find a actual list of people adhering to it. All I see is "G7 is doing it" but nothing else.

www.cnbc.com

www.cnbc.com

www.fxstreet.com

www.fxstreet.com

Meanwhile, the Russian Ministry of Finance thing has announced plans for a crypto coin with proof of stake that would be backed by gold, which sounds amazing.

villagemagazine.ie

villagemagazine.ie

www.coindesk.com

www.coindesk.com

G-7 nations to announce import ban on Russian gold as Moscow sanctions widen

The leaders of the G-7 nations will announce a ban on Russian gold imports for Moscow's unprovoked invasion of Ukraine, U.S. President Joe Biden confirmed on Sunday morning.

G7’s ban on Russian gold may not stop its drop

G7 countries are discussing refusing to import gold from Russia - another attempt to limit the country’s export earnings. However, this news is more a

Meanwhile, the Russian Ministry of Finance thing has announced plans for a crypto coin with proof of stake that would be backed by gold, which sounds amazing.

Currency warfronts: Russia is spearheading a gold- and commodity-backed Ruble, while Central Banks accelerate digital currencies which, without protections, will give them unlimited power to monitor and control how we spend our money. By Eddie Hobbs

Putin’s 9 May speech in Red Square came and went, without any new theatre opening up. This may indicate a change in strategy to limit the kinetic war to Donbas but he’s made it quite clear that, in his world view, the culpable protagonist, is NATO /USA. By moving away from military rhetoric his...

villagemagazine.ie

villagemagazine.ie

Gold-Backed Stablecoin Can Help Russia Circumvent Sanctions, Government-Owned Bank Suggests

The U.S. wouldn't be able to touch a “crypto-golden” ruble, VEB bank researchers say.

Or it will further destroy the Crypto marketMeanwhile, the Russian Ministry of Finance thing has announced plans for a crypto coin with proof of stake that would be backed by gold, which sounds amazing.

Agent23

Ни шагу назад!

Or it will further destroy the Crypto market

Post Apocalyptic Discussion Pruned Into Its Own Thread

What If We Were Compelled To Follow Our Childhood Dreams of Becoming "Road Warriors" in the Vein of the Mad Max Franchise of Films

What If We Were Compelled To Follow Our Childhood Dreams of Becoming "Road Warriors" in the Vein of the Mad Max Franchise of Films

Arch Dornan

Oh, lovely. They've sent me a mo-ron.

Oil shippers are hiding Russian cargoes by paying in Chinese yuan, exchanging weapons for crude, and 'going dark'

Carriers can easily mask the origins of Russian oil shipped to sanctions-averse buyers, sparking concern the products are entering Europe, per the Guardian.

The US petro dollar dominance is past its prime.

bintananth

behind a desk

Ask someone with no job who lives in a car if they're more worried about gasoline or dinner and they'll say gasoline.You can't make people forget about something they get reminded of every time they go to the pump or the grocery store.

They can get a free meal with ease. They can not get gasoline for free.

Users who are viewing this thread

Total: 2 (members: 0, guests: 2)