DarthOne

☦️

CNN Analyst Suggests Inflation Is Needed To Achieve Green Agenda

www.zerohedge.com

www.zerohedge.com

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

As we have covered in the past here on ZH, the inflation/stagflation crisis is immensely damaging to the average person, with the threat of poverty and food shortages hanging over the majority of the population, but there are some people out there who see the crisis as a boon, specifically for the Green agenda and carbon taxation.

CNN economic analyst Rana Foroohar follows the bizarre line of thinking in an interview with The Ezra Kline Show, suggesting that inflation is needed in order to pave the way for a carbon credit based economy. She argued:

“...This is something that I think, unfortunately, no politician, particularly the Democrats right now in advance of midterms or a presidential election want to land on, which is some of the transitions to a kinder, gentler, I believe more stable, and ultimately more resilient economy, are going to be inflationary in the short to medium term.

What’s the cost of something if you actually have a real price on carbon, and then you have to tally in how much it costs to tote it over tens of thousands of miles from the South China Seas? What’s the cost if you have proper environmental and labor standards? ...This is the conversation happening right now. And once you start pricing all those costs in, and you start really thinking of the economy in a different way, then yeah, it is certainly is inflationary..."

Foroohar then called on the U.S. and Europe to "put a price on carbon."

The analyst follows a relatively new trend among the political left and globalists in seeking to justify the existence of price inflation as a means to an end; the “greater good” being the induction of Green New Deal-style legislation.

Some propagandists in the media claim that the inflationary crisis is an opportunity, while others try to claim that climate change is the direct cause of inflation, and if we don't accept carbon taxation then we will continue to suffer under an inflationary collapse. But we all know what the game is here: To use public fears of financial disaster to lure people into accepting authoritarian environmentalism because “Prices are already high anyway, so why not?”

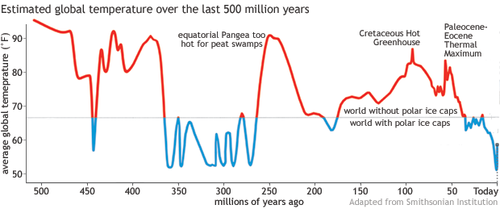

Even NASA and the NOAA openly admit that average global temperatures have only increased 1 degree Celsius in the past century. Yes, that's 1 degree we're supposed to be terrified of. Keep in mind that the official temperature record used by climate scientists started in the 1880s, so when the NOAA says that a recent temperature was “the hottest on record,” they are using a scale of a little over a century. That's a tiny sliver of time in the vast weather history of the Earth.

In fact, the Earth today is rather cool compared to the numerous warming periods of the past, and these spikes in heat coincided with thriving expanses of life. And, no man-made carbon emissions either. There is zero proof that man-made carbon is the cause of the Earth's current warming cycle.

Climate scientists, who receive large sums of money through funding as long as they toe the party line, argue that man-made carbon can be the only cause of climate change because “carbon rises as temperatures rise.” In other words, correlation = causation. This is not real science. They make no mention of the fact that warming also tends to lead to more life on the planet, and thus more carbon.

The facts of Earth's climate history are generally ignored for the sake of ideology. We are meant to believe that all those other warming periods were different, and this time warming (minimal warming) is caused only by car exhaust and industrialized cow farts?

Perhaps it is no coincidence that inflation is being exploited by Green ideologues and globalists as an excuse for carbon taxes? Maybe that was the plan all along?

High prices in gas force the public into mass transportation and less independence (only rich people will be able to afford electric cars). The public will be priced out of meat in their diet and be forced into vegetarianism/veganism (laboratory produced proteins lack the fats and fatty acids the human brain needs from real meats to function properly). The public will be priced out of private property and owning a home, forcing them into mass housing systems. They will be priced out of most retail goods, forcing them to accept the “Shared Economy” model created by the World Economic Foundation. And, they might be priced out of the economy altogether, forcing them to accept Universal Basic Income and total dependency on the government, not to mention having a family would be impossible, so the population control agenda is served as well.

The inflation issue is a panacea, but only for globalists and Green cultists, which is probably why they can barely contain their excitement when discussing it.